Optical comms market set for 100G surge in 2016

source:optics.org

keywords: optical data center Oclaro

Time:2015-05-25

In the optical communications markets, demand for 40G transceivers is now “ramping up hard” as data centers deploy 40GbE (Ethernet), particularly as a high-density 10G interface via breakout cables. Also, 40G QSFP (quad small form factor pluggable) demand growth over single-mode fiber is the consequence of large shipments to internet content providers Microsoft and Google. These are the key conclusions of the latest transceiver market analysis by IHS Infonetics.

“The main types of optical communications devices in demand will be CFP2-ACO [CFP2 form factor pluggable analogue coherent optics] based on indium phosphide. This will be the breakout technology for photonic integration. I don't think 2016 will be a breakout year for silicon photonics, except in PSM4 QSFP28 applications, which will ramp.”

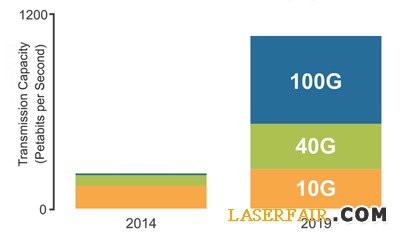

The market analyst's biannual 10G/40G/100G Data Center Optics market size and forecast report tracks optical transceivers, or short reach optics, by speed, reach, wavelength and form factor. Considering the financial implications of these changes, the analyst reports that revenue from 10-, 40- and 100-Gigabit optical transceivers sold into the enterprise and data center markets grew 21% in 2014 to hit $1.4 billion, almost entirely due to increased 40G QSFP spending.

Andrew Schmitt, research director for carrier transport networking at IHS Infonetics, commented “The market for 100G data center optics is accelerating, but it has yet to be turbocharged by widespread data center deployment in the way 40G QSFP optics have. This will change dramatically in 2016 as cheap 100G silicon reaches production and QSFP28 shipments surge as a result. Next year is going to be huge for 100GbE.”

Schmitt told optics.org why he expects to see a significant change in the 100G datacenter market place next year: “All of the key components needed for low cost 100GbE will be in place, including QSFP28 optics. The large internet content providers are all planning to shift to 100GbE in 2016 and this will drive enormous sales volumes.

“The main types of optical communications devices in demand will be CFP2-ACO [CFP2 form factor pluggable analogue coherent optics] based on indium phosphide. This will be the breakout technology for photonic integration. I don't think 2016 will be a breakout year for silicon photonics, except in PSM4 QSFP28 applications, which will ramp.”

So which suppliers can expect to have significant market positions if these forecast changes come to pass? Schmitt commented, “I think the leader in CFP2-ACO will be Oclaro. The likes of Luxtera and Innolight will appear in 2km solutions, although the usual suspects, including IBM and Intel will likely be there as well.”

The expected growth in sales of relatively new technologies will be accompanied by a corresponding fall in older, alternative technologies. Schmitt said, “The IHS Infonetics numbers clearly show that 10G is already dying in the WDM area. The forecast growth for datacenter optics is really about the large-scale internet content providers moving very rapidly towards 100Gb Ethernet.”

Datacenter optics market report highlights

Data center transceivers account for 65% of the overall (telecom and datacom) 10G/40G/100G optical transceiver market.

Total 40G transceiver revenue grew 81% in the second half of 2014 over the same period a year ago

10G shipments in the data center continue to grow at “healthy” rates, but are being impacted by growth of 40G interfaces used as high-density 10G interfaces

Meanwhile, worldwide revenue for client 10G modules was flat on a year-over‑year basis in 2014 and IHS Infonetics expects the datacom optical transceiver market to grow to over $2.1 billion by 2019

IHS Infonetics’ biannual 10G/40G/100G data center optics report provides worldwide market size, forecasts through 2019, analysis and trends for manufacturer revenue, units shipped and ARPU. The report analyzes the optical transceiver market by module speed (10G, 40G, 100G), reach, wavelength and form factor. To purchase the report, contact IHS Infonetics.

MOST READ

- RoboSense is to Produce the First Chinese Multi-beam LiDAR

- China is to Accelerate the Development of Laser Hardening Application

- Han’s Laser Buys Canadian Fiber Specialist CorActive

- SPI Lasers continues it expansion in China, appointing a dedicated Sales Director

- Laser Coating Removal Robot for Aircraft

PRODUCTS

FISBA exhibits Customized Solutions for Minimally Invasive Medical Endoscopic Devices at COMPAMED in

FISBA exhibits Customized Solutions for Minimally Invasive Medical Endoscopic Devices at COMPAMED in New Active Alignment System for the Coupling of Photonic Structures to Fiber Arrays

New Active Alignment System for the Coupling of Photonic Structures to Fiber Arrays A new industrial compression module by Amplitude

A new industrial compression module by Amplitude Menhir Photonics Introduces the MENHIR-1550 The Industry's First Turnkey Femtosecond Laser of

Menhir Photonics Introduces the MENHIR-1550 The Industry's First Turnkey Femtosecond Laser of Shenzhen DNE Laser introduced new generation D-FAST cutting machine (12000 W)

more>>

Shenzhen DNE Laser introduced new generation D-FAST cutting machine (12000 W)

more>>